Gift Tax Exemption 2025 Irs - The exemption currently stands at a generous $13.61 million per individual (this is set to expire december 31, 2025, dropping to approximately $7.5 million). IRS Announces Estate And Gift Tax Exemption Amounts For 2023 Seder, How much is the gift tax rate? The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2023.

The exemption currently stands at a generous $13.61 million per individual (this is set to expire december 31, 2025, dropping to approximately $7.5 million).

For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. The maximum credit allowed for adoptions for tax year 2025 is the amount of qualified adoption expenses up to $16,810, increased from $15,950 for 2023.

What is the Lifetime Gift Tax Exemption and When Will It Be Cut? YouTube, Which gifts are exempt from the federal gift tax? The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.

Scary Minecraft Seeds 2025. Browse and download minecraft horror maps by the planet minecraft. Here, […]

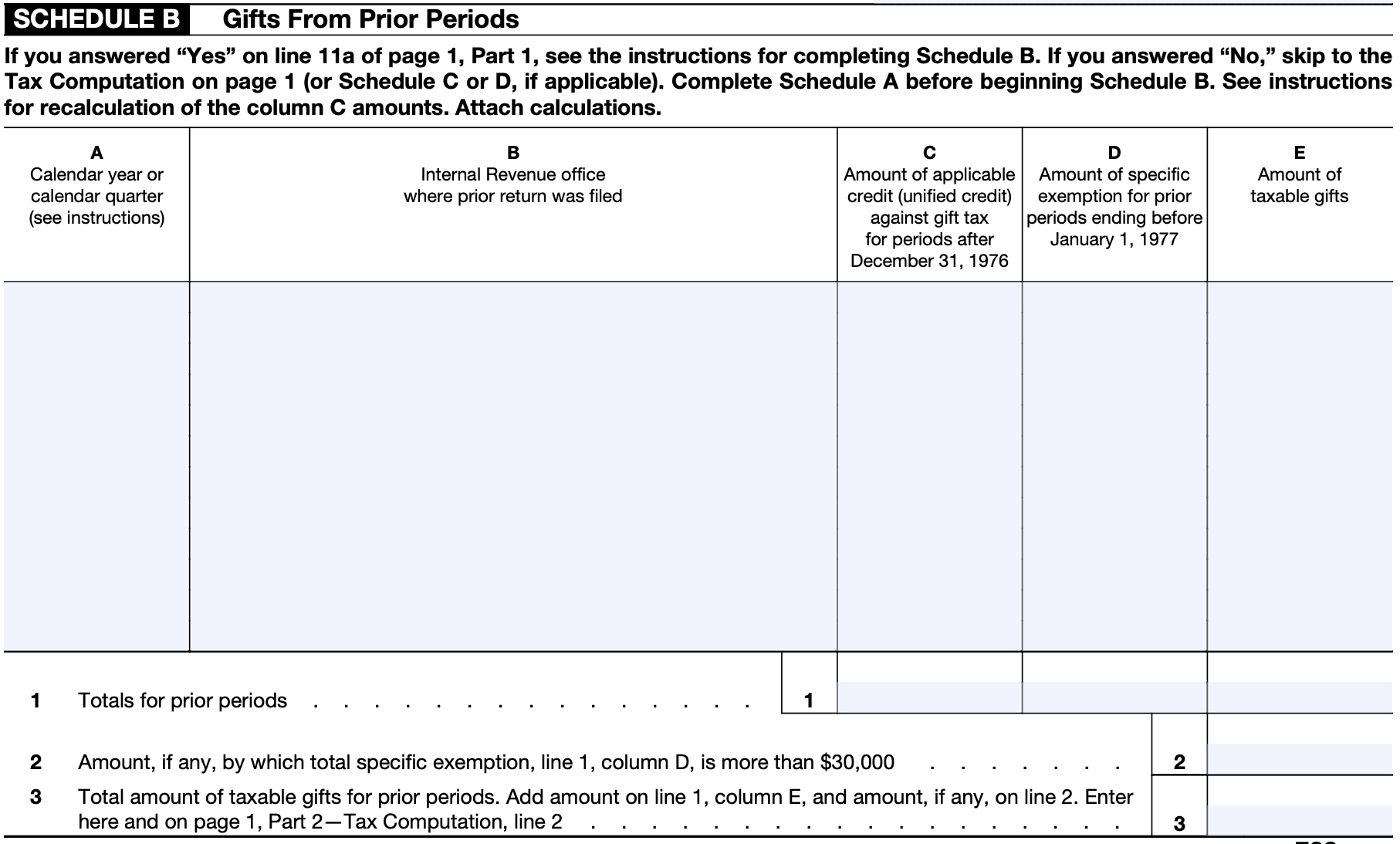

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax, What is gift tax in india? Which gifts are exempt from the federal gift tax?

Gift Tax Exemption 2025 Irs. Givers, not receivers, pay the federal gift tax, but you can give away up to $12.92 million in cash or other assets during your lifetime (tax year 2023) without triggering the gift tax. This limit is adjusted each year.

The 2025 Estate & Gift Tax Exemption Amount Set to Rise Again Geiger, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). For 2025, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

Annual Gift Tax Exclusion A Complete Guide To Gifting, The exemption is first used to offset gift taxes on taxable gifts made during one’s lifetime. Barring an extension or new legislation, the.

Gift Tax Lifetime Exemption 2025 Barb Marice, Givers, not receivers, pay the federal gift tax, but you can give away up to $12.92 million in cash or other assets during your lifetime (tax year 2023) without triggering the gift tax. The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.

IRS Announces Increased Gift And Estate Tax Exemption For 2025, Information to help you resolve the final tax issues of a deceased taxpayer and their estate. There's no limit on the number of individual gifts that can be made, and couples can give double that amount if they elect to split gifts.

Aia National Conference 2025 Atlanta. Register for the aia leadership summit, the premier. Aia conference […]